Tax Prep - What is 1099?

It’s tax season! Whether you are new to being a 1099 contractor, or you’ve been self-employed your whole career, it’s always a good idea to review what your tax status is and how it works. Advanced Funeral Planners at Precoa are 1099 contractors. You receive a 1099-MISC tax form from Precoa for your previous year’s earnings. IRS.gov has a lot of resources available for 1099 contractors. If you want a basic refresher on how taxes may work for you, check out this PDF: 1099 worksheet_2023.pdf.

Refer a Friend!

https://vimeo.com/1108213052?share=copy&fl=sv&fe=ci You know how meaningful this work can be. The impact, the purpose, the people. If someone in your life is searching for more—more connection, more growth, more meaning—let them know about advance planning...

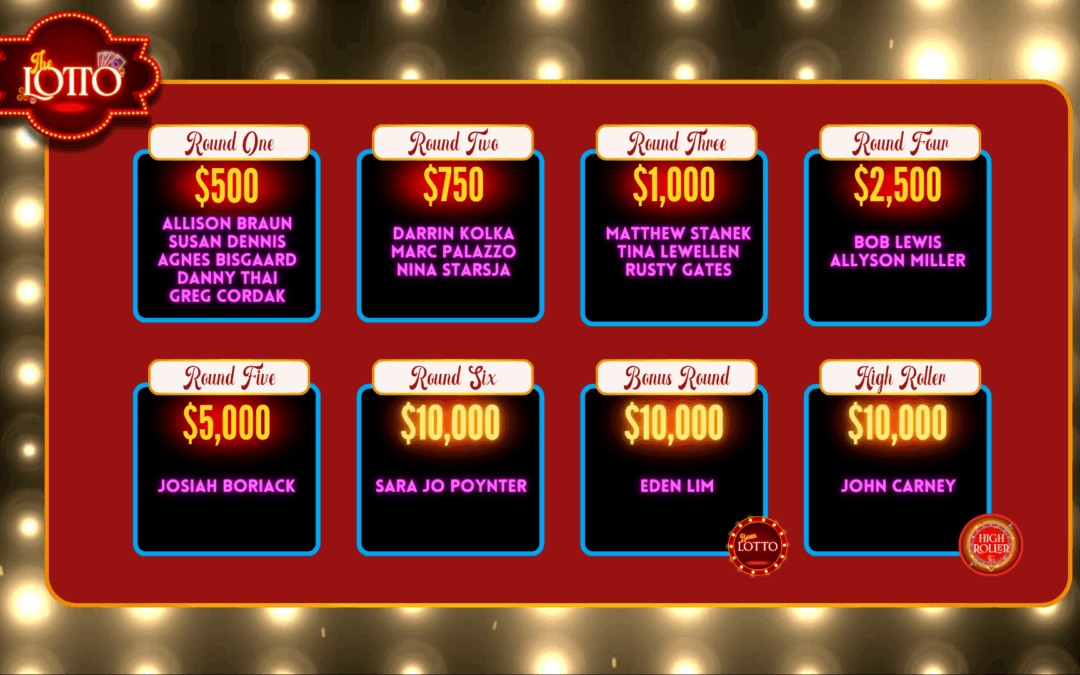

Congratulations To Our Winners!

We’re thrilled to celebrate our lucky winners from The Big Deal Lotto! Your dedication and effort have truly paid off — Congratulations! To every Advance Funeral Planner across the country, thank you for your incredible work serving families with compassion and...

Tune in TODAY!

Be sure to join us TODAY at 12 PM Pacific/3 PM Eastern for The Big Deal Finale! We'll be running The Lotto for all Advance Funeral Planners who earned an entry during the incentive period. Here's the link to join: https://Precoa.zoom.us/my/connectionspace See you...

The Big Deal Finale Link

Be sure to join us tomorrow, November 6 at 12 PM Pacific/3 PM Eastern for The Big Deal Finale! We'll be running The Lotto for all Advance Funeral Planners who earned an entry during the incentive period. Here's the link to join:...

Live Lotto Information

Thursday, November 6 • 12:00 PM Pacific / 3:00 PM EasternJoin us live on Zoom — link coming soon! It’s almost time for The Big Deal Finale, where 17 live lotto draws will decide who walks away with thousands of dollars in prize winnings! Mark your calendars now —...

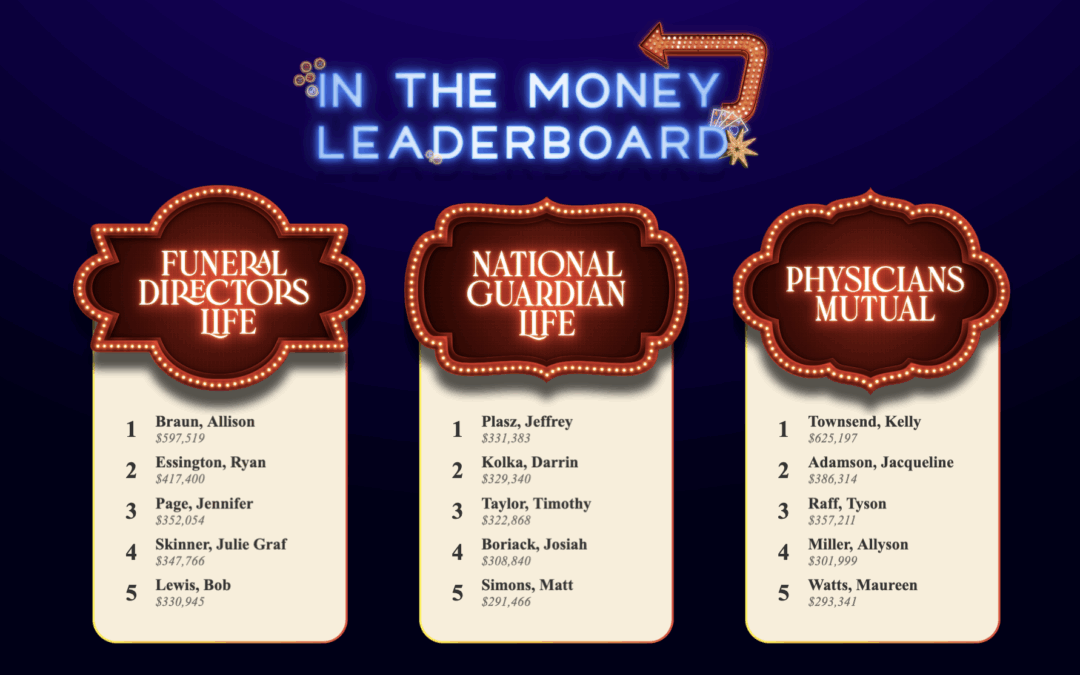

In The Money Winners!

We’re thrilled to officially announce the In The Money game winners from The Big Deal Incentive! These Advance Funeral Planners worked hard to rise to the top of their leaderboards — and they’re each walking away with a guaranteed payday for their efforts. 5th...

Thank You

The Big Deal has officially come to a close — and what a finish! Over the past several weeks, you’ve gone above and beyond, helping families across America find peace of mind. Your hard work, compassion, and dedication made this incentive a huge success, and we...

The Vault is OPEN!

You did it! Together, with one day to spare, we hit $70 million in total sales during this incentive period — and that means the Vault is OPEN. Inside? A massive $20,000 more prize dollars added to the pool! Here’s what’s now up for grabs in the Lotto: 5 x $500 draws...

Guess Who’s Back

https://vimeo.com/1123434764/5bbf2c1c45?share=copy Guess who’s back just in time for The Big Deal?!?You’ve seen him in a past incentive… and now he’s making his return.Hit play to see the familiar face behind the silhouette!

Big Deal or No Big Deal

https://vimeo.com/1122730175/b1f303e0da?share=copy Our friends at Funeral Directors Life pulled some strings and brought in none other than Chip Mandel (yes—cousin of Howie Mandel!) to host a special episode just for The Big Deal Incentive. And if you think Chip looks...

Tax Prep - What is 1099?

It’s tax season! Whether you are new to being a 1099 contractor, or you’ve been self-employed your whole career, it’s always a good idea to review what your tax status is and how it works. Advanced Funeral Planners at Precoa are 1099 contractors. You receive a 1099-MISC tax form from Precoa for your previous year’s earnings. IRS.gov has a lot of resources available for 1099 contractors. If you want a basic refresher on how taxes may work for you, check out this PDF: 1099 worksheet_2023.pdf.

How to Qualify for Escapes

Did you make it on the Thailand trip? Are you setting your sights on next year’s destination? Make sure you know how to qualify for Precoa Escapes trips, and how to earn points for business between February 1, 2023 and January 31, 2024.

You can earn:

- One award point for all single pay sales (including EPOs) at age 76 and up and all TIs (+1 bonus point for Home Visits)

- Two award points for all other sales from national leads (+1 bonus point for Home Visits)

- Three award points for all other sales from local lead sources (+1 bonus point for Home Visits)

- 5,000 award points for each OAP membership sold

- Minus any chargebacks—If you’re charged back dollars, you’ll be charged back the proportionate number of points to match the new policy value. Chargebacks after the qualification deadline will be applied to next year’s incentive trip point total. *Unique rules apply for some funeral homes including Selected Services; please confirm with your manager if you have any questions.

You must earn a minimum of 1,500,000 points by January 31, 2024 to qualify for the trip. Additional points can be used for room upgrades, extra nights, excursions, etc. Rollover points carried over from previous years can be used for upgrades and excursions once the AFP or manager has already qualified.

2024 Precoa Escapes Reveal

Join us right now at escape.precoa.com as we reveal the location of our 2024 Precoa Escapes Destination!